With the COVID pandemic and our collective desire to avoid physical contact, it’s no surprise that there have been profound changes in the way we bank as well as pay for goods and services.

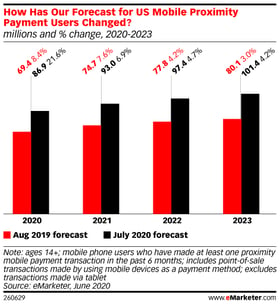

Proximity payment apps, like those that are native on your mobile phone or are provided by digital financial services companies, have become a big part of our lives and are an essential tool we rely upon for touchless transactions. As a result, industry prognosticators have had to revise their growth projections for those apps and online banking this year.

At the close of 2020 in the US, there will be a total of over 189 million users of online banking and nearly 18 million more proximity payment app users than originally anticipated. And as new users get used to new payment methods and spending, there’s an opportunity for scammers to take advantage of their broadscale unfamiliarity and bilk them out of their hard-earned cash. So much so that the FBI issued a public service announcement warning of these scams earlier this year.

Most of the malicious activity is not inventive. Bad actors re-hash seemingly age-old credential theft scams like fake support or even phishing attacks, while others have reinvented pyramid schemes and new versions of “Nigerian 419” fraud. And for the more technically inclined criminal, there are look-a-like apps on third-party app stores and legitimate apps that have been bundled with malware.

And the pitfalls don’t end there. As we rely more on our phones and digital methods to conduct our daily lives more safely, bad actors lay their net of deceit. To learn about how to protect your company and customers from these scams over the holiday season, click here to listen to the free webinar “Internet Infringement Doesn’t Take a Holiday.”

We also offer strategies and tactics to secure your brand in digital channels in our resource page.